You can adjust your GST/VAT codes and percentages per currency under the Setup > GST/VAT Setup menu

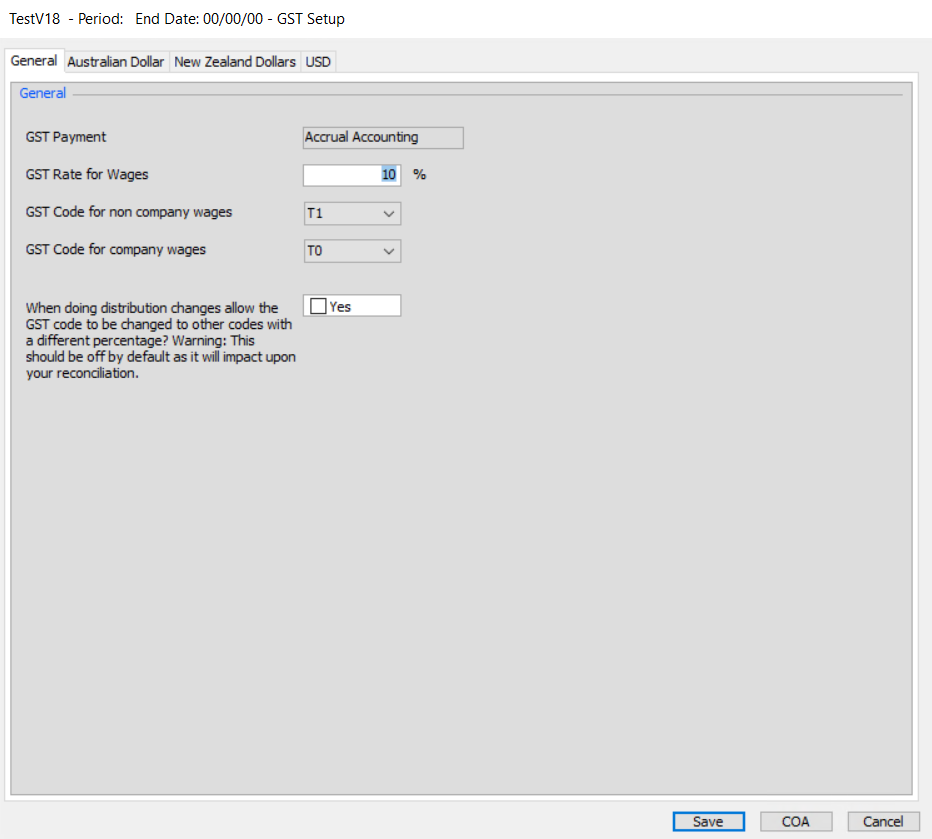

You will be presented with the below screen with the ability to set the default GST/VAT for wages if applicable.

You will be presented with the below screen with the ability to set the default GST/VAT for wages if applicable.

GST/ VAT Codes & Rates

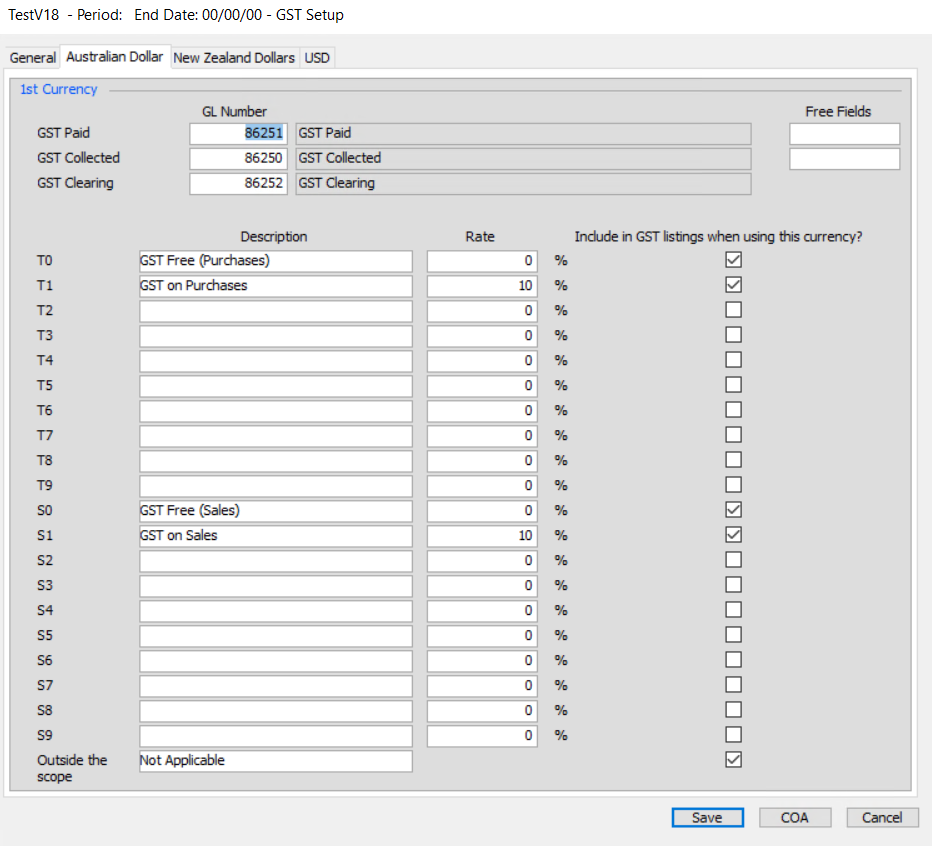

There will be one tab on this screen for each currency in use that will look as follows.

From here you can change:

- GST/VAT Paid – When a transaction with a T0-T9 code is posted, the GST/VAT paid element will be posted to this code.

- GST/VAT Collected – When a transaction with a T0-S1 code is posted, the GST/VAT collected element will be posted to this code.

- GST/VAT Clearing – When the GST/VAT Reconciliation is run, the system will automatically clear out the Paid/Collected codes and place the balance in the clearing code.

- GST/VAT Codes – You can customize up to 20 rates; 10 for purchases (T0 – T9) and 10 for Sales (S0 – S9) and select whether these rates are available during data entry. Outside the Scope (OS) is always set to 0%.

For help setting up GST/VAT codes, check our guidance on Chart of Accounts.