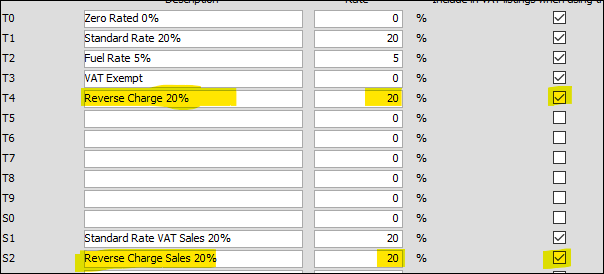

Head to ‘Setup > VAT Setup’, and click into the currency tab at the top for the respective currency. You’ll want to create two new codes for Reverse VAT, one in the T codes and one in the S codes as below (this doesn’t have to be T4/S2 specifically):

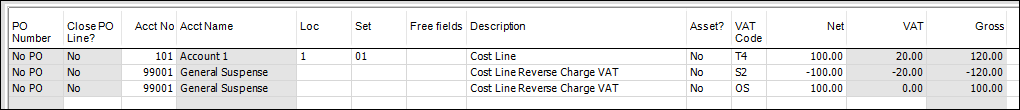

Once they exist, enter the invoice similar to the below where the cost is coded to the purchases reverse charge code, and a reversal line is put in against the suspense code with the sales reverse charge code. Finally put in a new line against the suspense code as OS to balance out the transaction.

The end result here is that it will populate box 1, 4, 6 and 7 on the return and the VAT portion will cancel itself out.