Single Touch Payroll (STP) is an Australian Government initiative to streamline business reporting obligations, which is due to become compulsory from 1 July 2018. When an employer pays their employees, the payroll information will be sent to the ATO through your software.

Reporting under the new system removes the requirement to issue payment summaries, provide annual reports, please find the link below for further information.

https://www.ato.gov.au/uploadedFiles/Content/CR/downloads/stp_factsheet.pdf

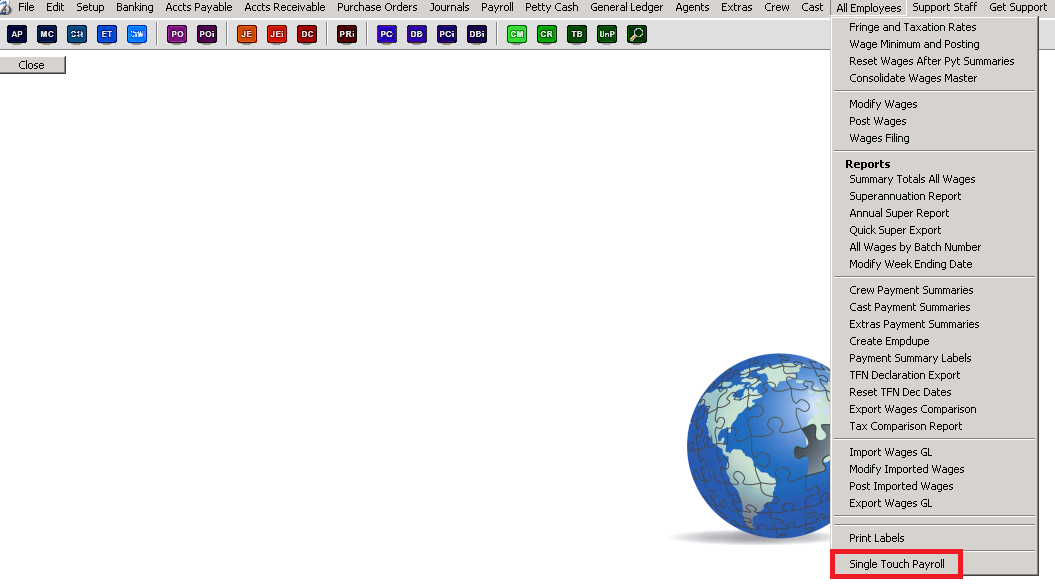

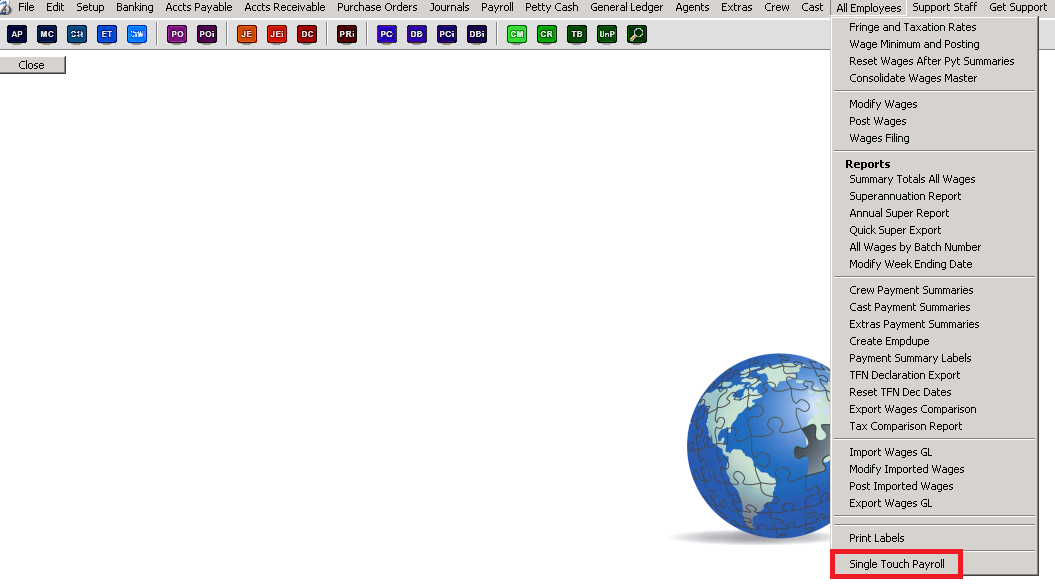

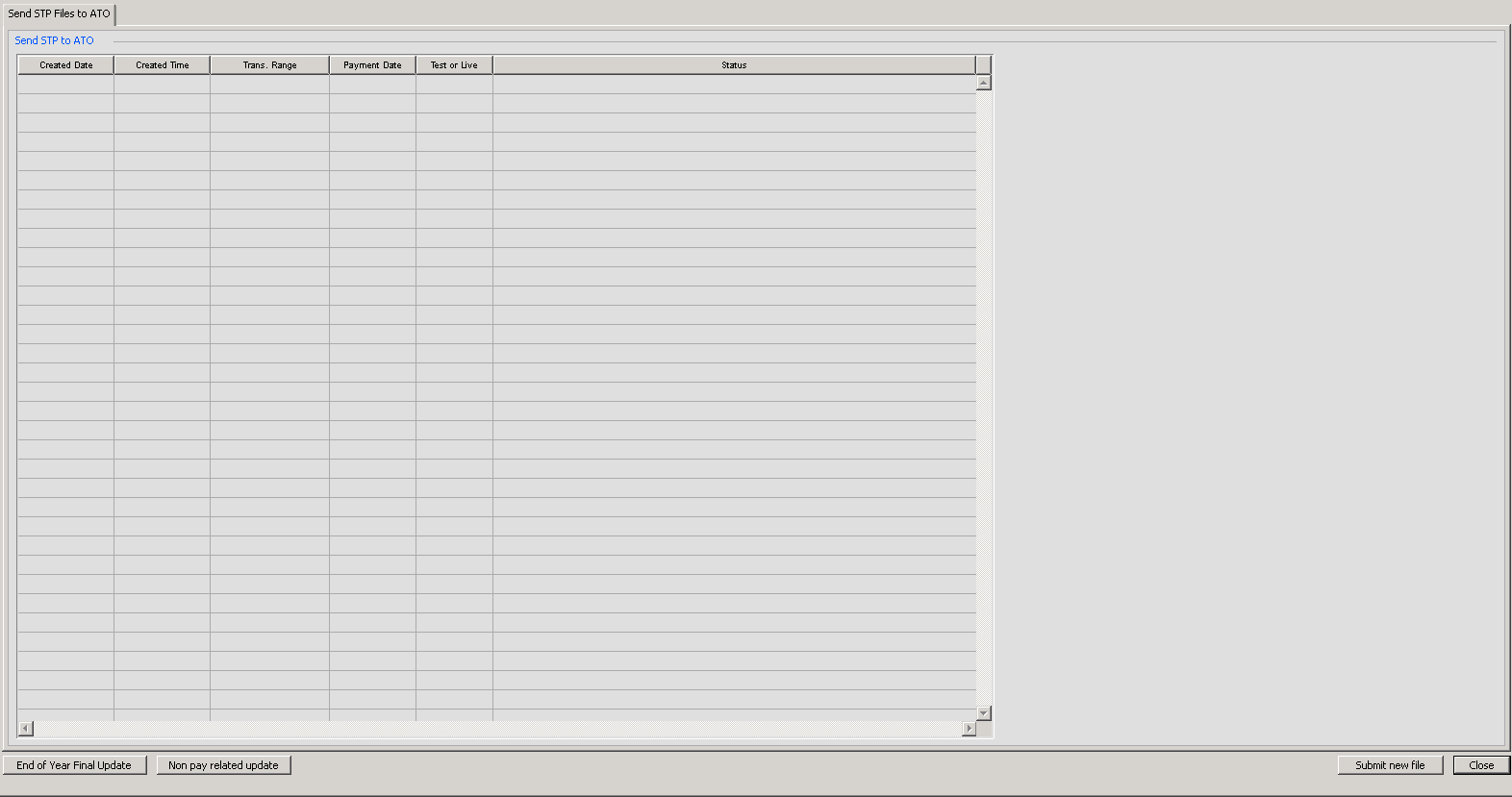

To access STP in Moneypenny go to the menu All Employees>Single Touch Payroll

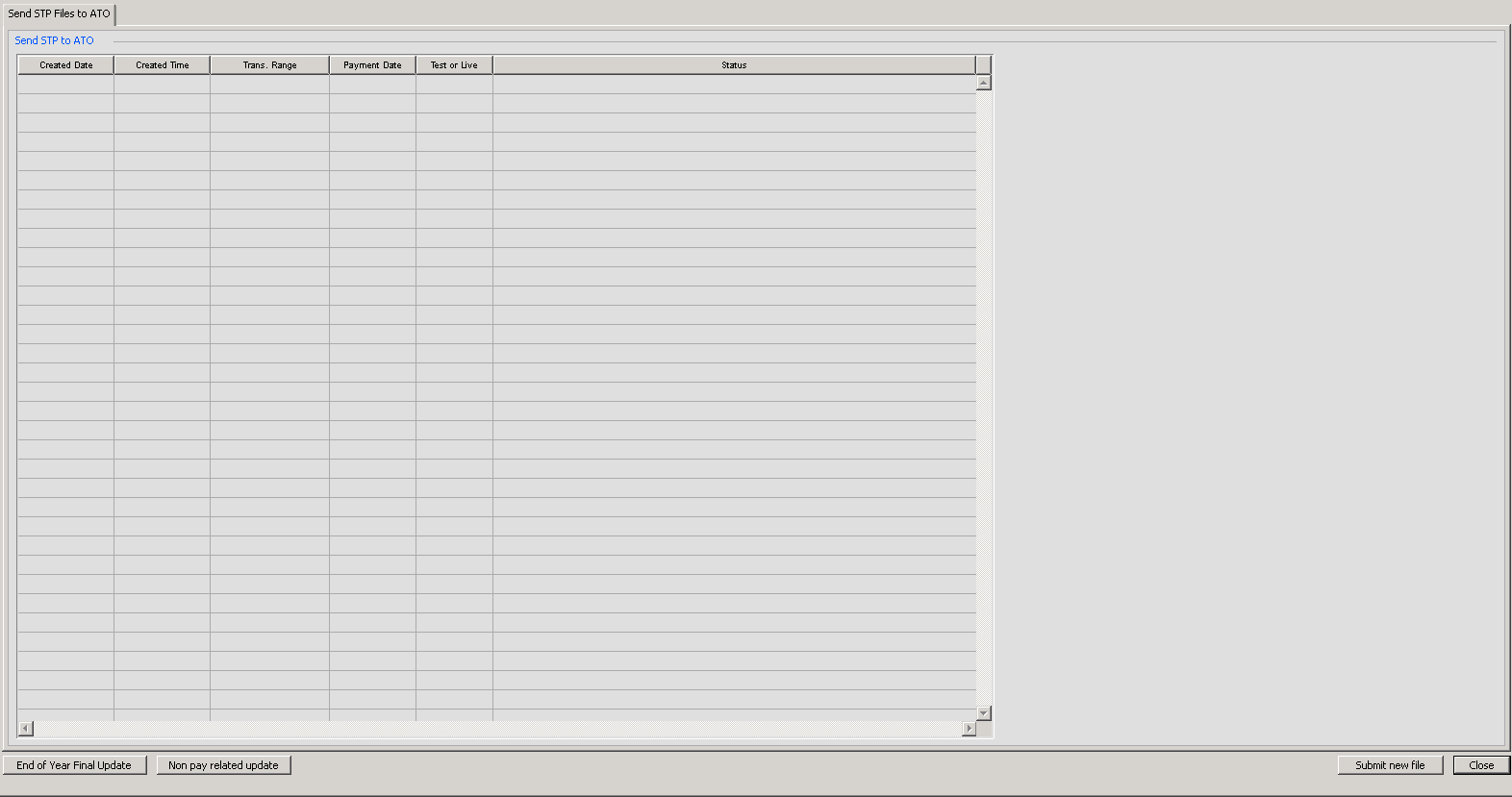

The following screen will appear

Preparing work before the beginning of the new financial year

Before the beginning of the new financial year we recommend that you run a test to confirm that the Cast/Crew/Extras masterfiles are complete and not missing any information which would prevent you from successfully submitting STP.

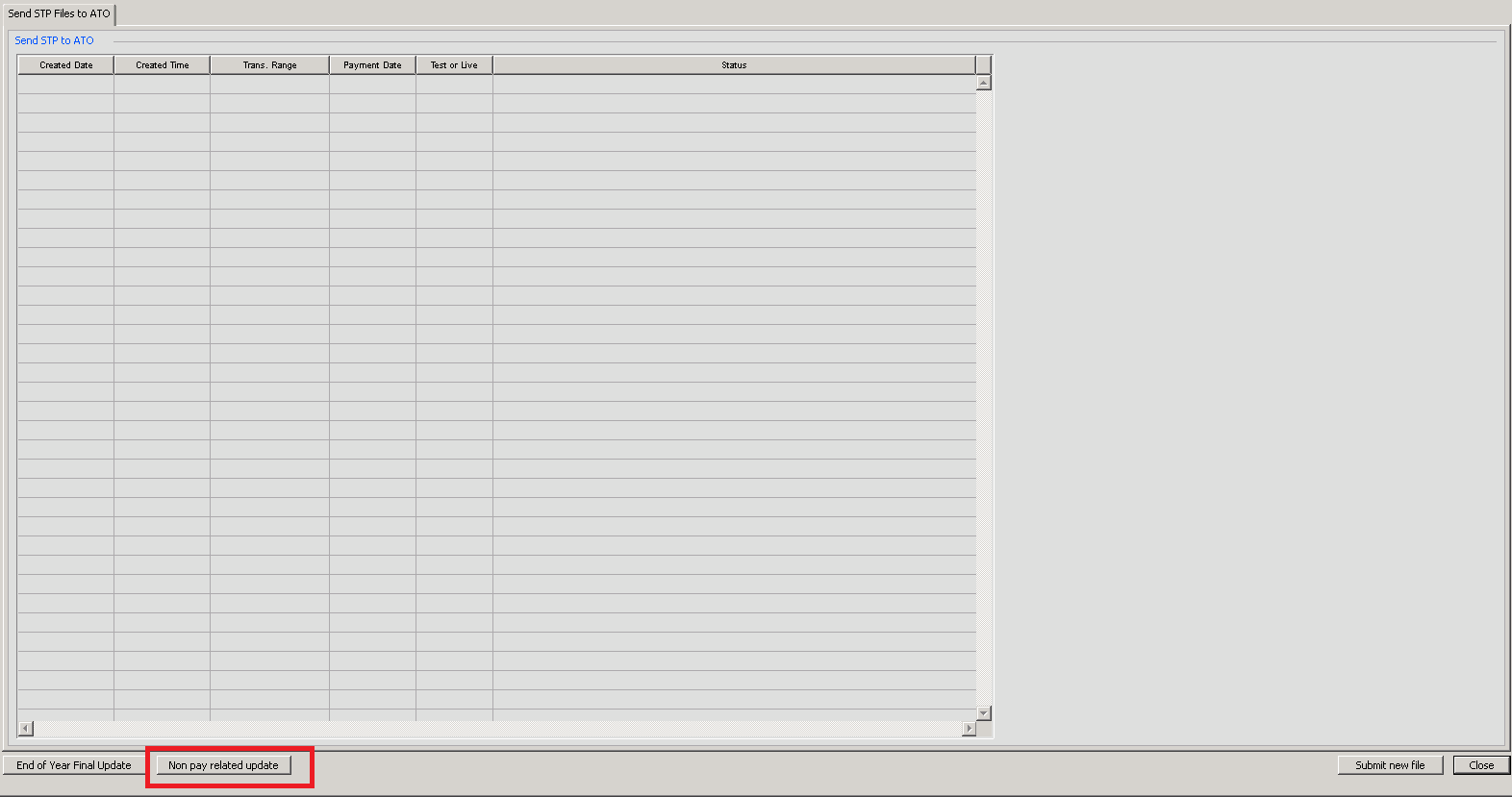

To do this, click on the button Non pay related update (as below)

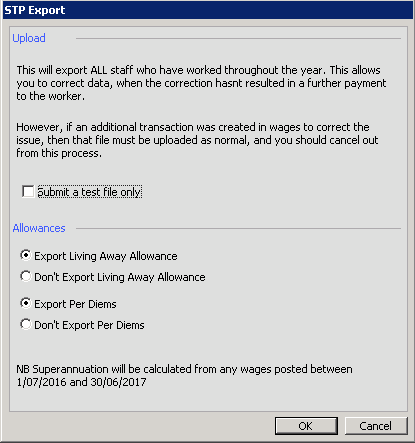

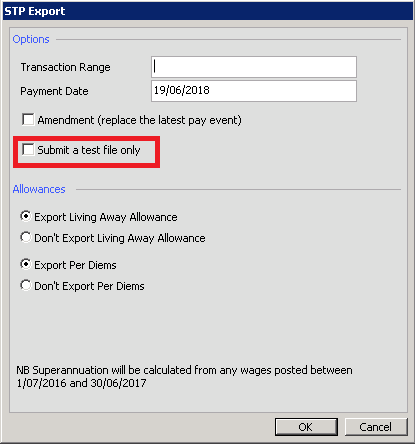

Then in the dialog box below select Submit a test file only

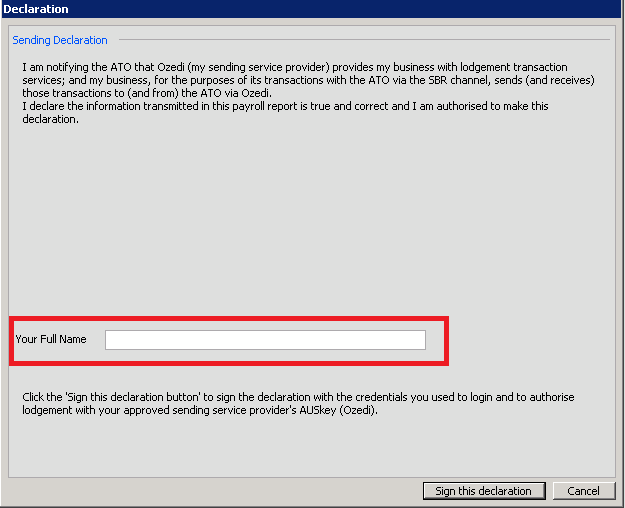

You will then see the following screen

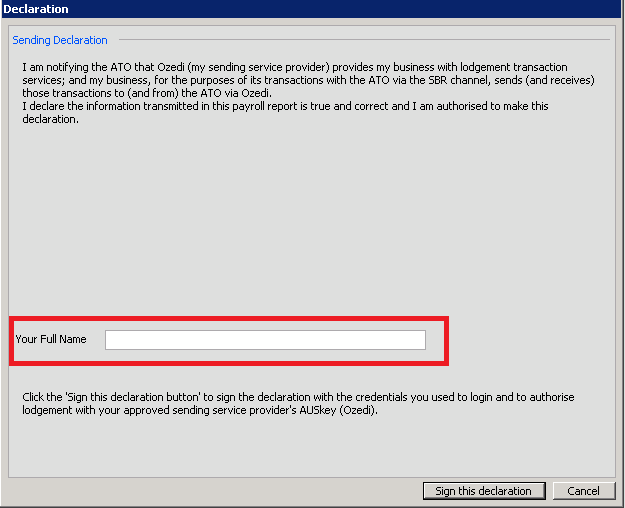

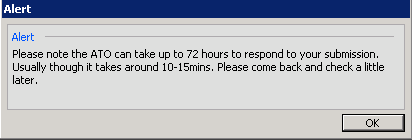

Type in your full name and then click the button Sign this Declaration. The following alert will appear, click OK

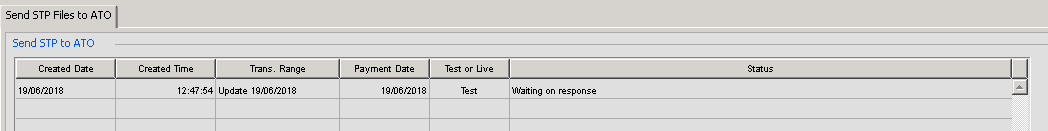

This will take you back to the original list but you will see now that you are waiting for the results of this test

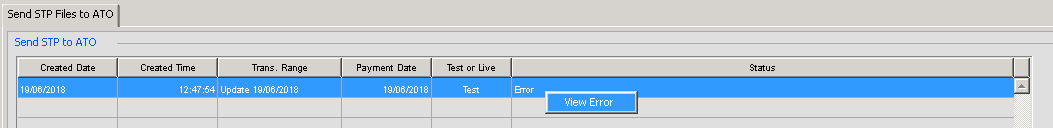

Close this screen and come back to it in approximately 10-15mins. Check again if the test has been successful by viewing this list. In this example, the test was unsuccessful – see below

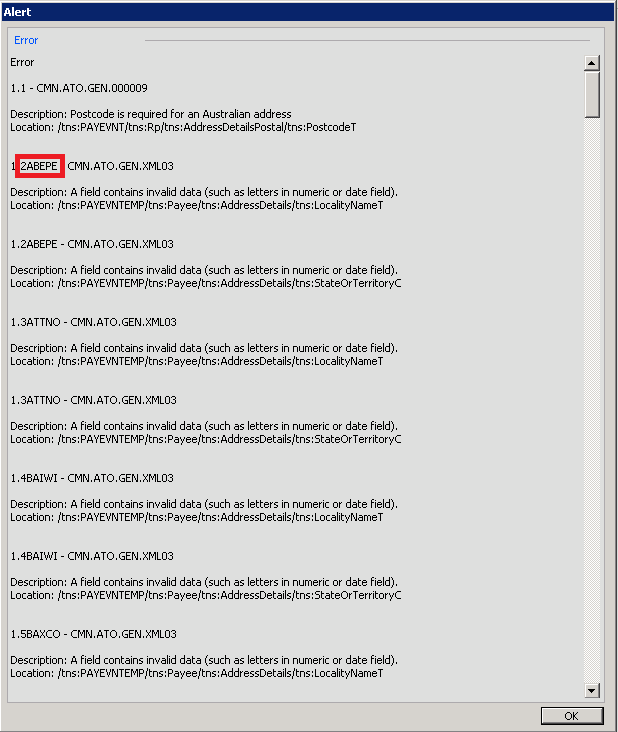

To view the error report, select the line then right click and select View Error. The following is the error report you will receive. We have provided you with as much information as possible to work out the issue. The information indicated below is the wages code

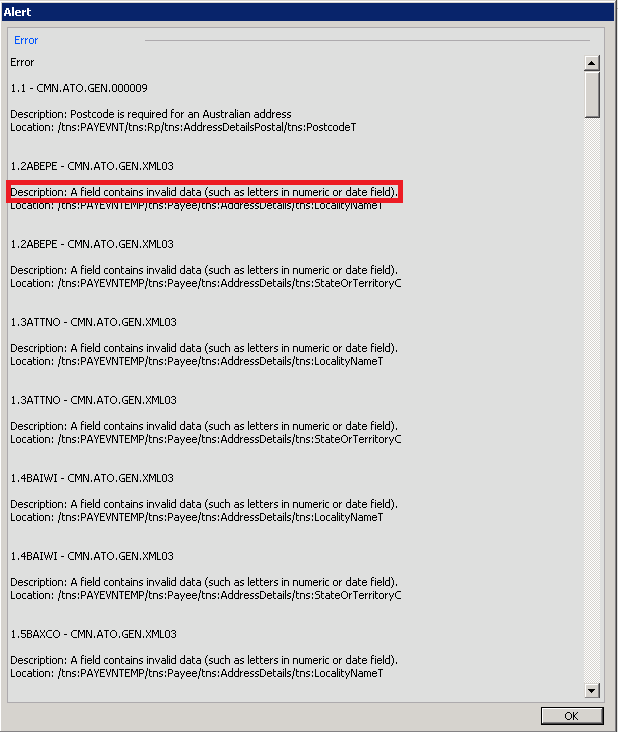

The information in the next screen shot is information on what the problem is, in this case a field is missing information required by the ATO.

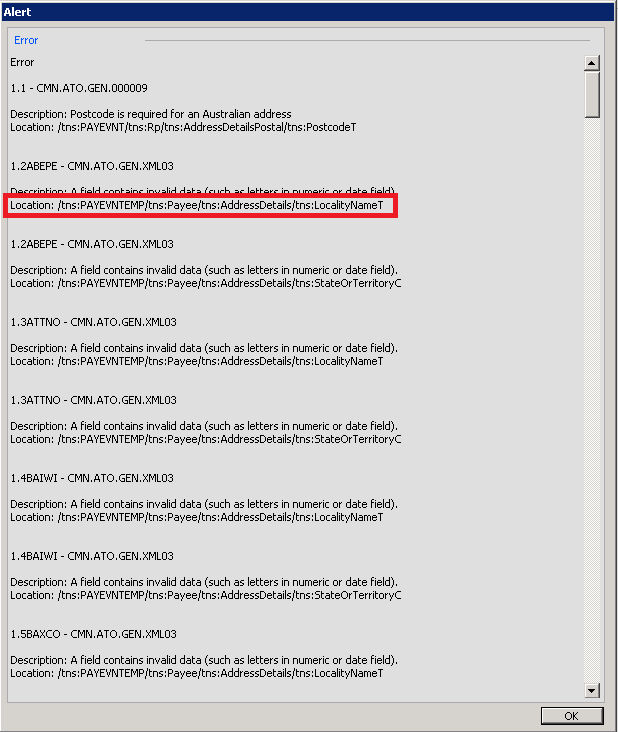

The information below indicates where this information is missing, for this example the person Masterfile doesn’t have an address.

Work through each of these errors and once complete do another test to confirm that you have everything fixed. Once completed this will mean that you will only need to run this test for all new cast/crew/extras entered into the datafile in the future.

The fields which are required by the ATO for example are:

- cast/crew/extra/company Address

- TFN

- company phone number

How to submit STP?

To access STP in Moneypenny go to the menu All Employees>Single Touch Payroll

The following screen will appear

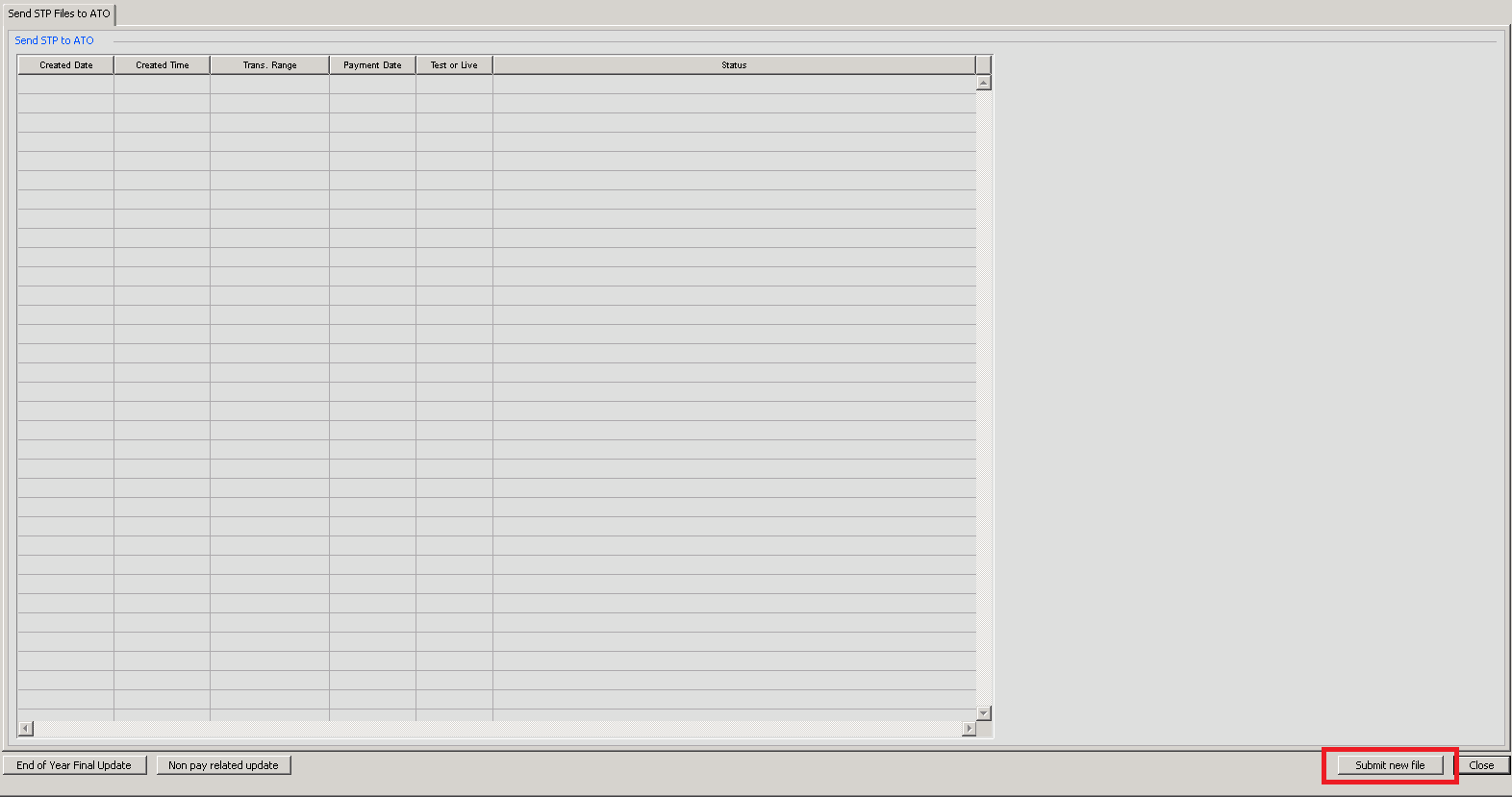

Click on the button Submit New File

The following screen will appear. You need to firstly enter in the transaction number(s) of the wages paid. Please note, STP must be submitted the same day as the wages are paid. Because of this we would recommend that the wages be handle first thing in the morning encase there happen to be any issues with regards to the information sent to STP.

To ensure that the STP submission has no errors, submit a test file only to begin with by ticking the filed indicated below. Then click the OK button

You will then see the following screen

Type in your full name and then click the button Sign this Declaration. The following alert will appear, click OK

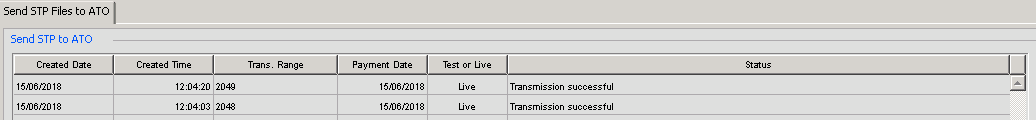

This will take you back to the original list but you will see now that you are waiting for the results of this test. Close this screen and come back to it in approximately 10-15mins. Check again if the test has been successful by viewing this list.

Should it be un successful, view the error report (as above) and fix the errors.

Should it be successful them click on Submit New File but do not tick the Submit Test File only and follow the rest of the steps.

Once a response is received back from the ATO the list and the submission has been successful then you will see the following:

How to Make an Amend to a transaction already submitted to STP

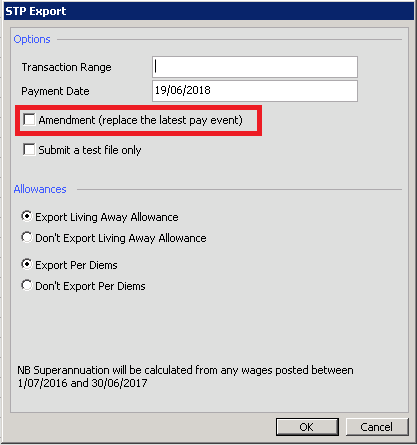

If you have had to make an amendment to a wage transaction, you will need to submit new file and then tick Amendment (replace the latest pay event).

Please note that if you try to submit the amendment on the same day as the original submission the ATO may give you an error saying that you there is already a submission with this reference number made today, wait one day and try again. Also be careful with regards to submitting multiple amendments in one day for your project, the ATO might have a problem with this.

You have 14 days in which to complete this from the first submission.

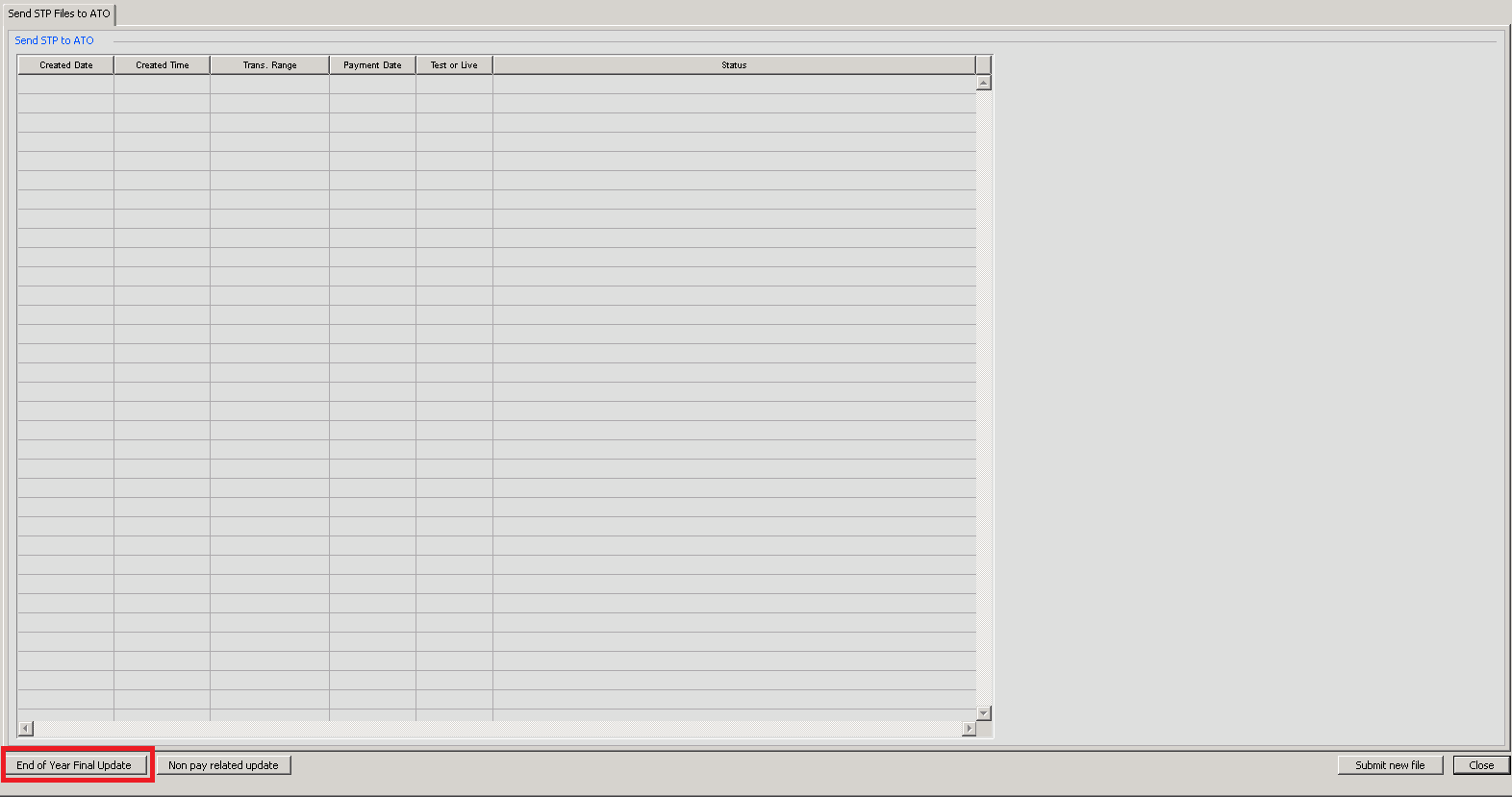

What happens at the end of each financial year?

Please note:

You will need to complete the End of Year Final Update and then “Reset Wages after payment Summaries” before you enter anything into the new financial year.

With STP, payment summaries are no longer required. All you need to do is click on the button End of Year Final Update and following the instructions.

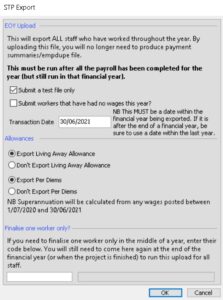

The following screen will appear. We always recommend that you Submit a test file only to being with.

Once the test is successful, right click the test line and select Print Report. Match this report against your payment summaries. Once you have reconciled the test submission successfully, then submit it live. We would recommend to keep a copy of the print report on the live submission for your records.

If you need to speak to someone at the ATO with regards to STP, the best phone number to call is 132866