Purpose

This menu item is the main form to enter or edit your chart of accounts. You can add new accounts from here or move around accounts as required.

How to use

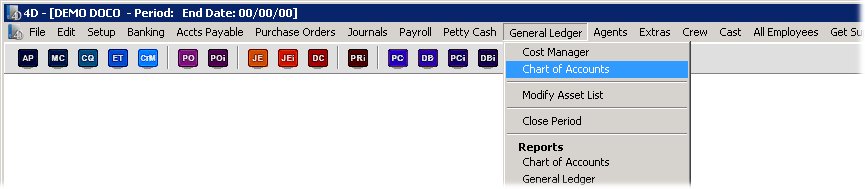

To view your chart, select ‘Chart of Accounts’ from the ‘General Ledger’ menu as shown below.

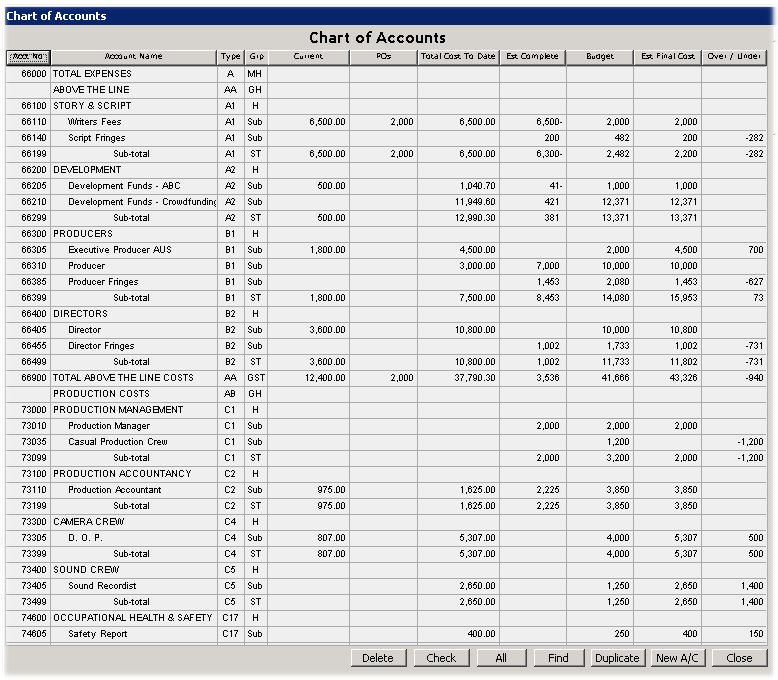

You will then be presented with the following form containing a list of all of your accounts. As usual you can click the buttons above each column to sort the records in that order.

From this screen you can press the ‘Check’ button to check that your account groupings have been setup logically. You can choose to delete an account as long as it has no YTD totals in this year or last or add in a new account.

You can also double click a row if you wish to view/edit in more detail. You will then see the data entry form as shown below.

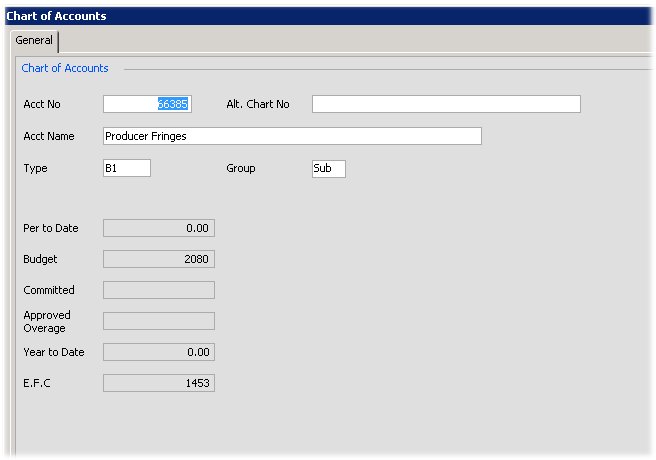

As usual you can only alter the fields shown in white. The rest are for information only.

In the above screen the account number and name are obviously used to number and label the individual accounts.

The account group is used to construct your ledger and inform mydaEs what accounts should be allowed to be entered into, and what should be added up to make your various sub-totals. There are several values allowed here.

SUB=These are the accounts that funds can be applied to.

H=Header account, which must be above a group of SUBs

ST=Subtotal account, which must be below a group of SUBs. mydaEs will add up the values above to create the subtotal.

NB Between a H and an ST, only SUBs can exist.

Next there are several nested levels of headers and further matching subtotals.

MH stands for Master Header, and is matched by a MHS, further down your ledger. It is commonly used to encapsulate the entire P&L accounts, and then the Balance sheet accounts. Please note a MH has to be finished by a MHS before another MH can be used.

GH stands for General Header and is matched by a GST (not to be confused with Goods and Services tax), here it is just a general subtotal. It can be used to group any other series of accounts in your ledger as you desire. Please note a GH has to be finished by a GST before another GH can be applied.

The same then can also be said for JH-JST/BH-BST/SH-SST etc

Please see the example below. Each level has been indented to make it clearer to understand.

| MH | |||||

| GH | |||||

| SH | |||||

| H | |||||

| SUB | |||||

| SUB | |||||

| SUB | |||||

| SUB | |||||

| SUB | |||||

| ST | |||||

| H | |||||

| Sub | |||||

| SUB | |||||

| ST | |||||

| SST | |||||

| SH | |||||

| JH | |||||

| H | |||||

| SUB | |||||

| SUB | |||||

| ST | |||||

| JST | |||||

| SST | |||||

| GST | |||||

| MHS |

Please contact your mydaEs support representative for more information or assistance here.

The account type is used to differentiate between different sub groupings.