Overview

From April 2019, any VAT registered business with a taxable turnover over £85,000 must follow the new rules for Making Tax Digital, requiring that all VAT records are stored digitally and submitted directly to the HMRC using compatable software.

This page will guide you through the process of submitting your VAT return to HMRC from within Moneypenny for Making Tax Digital. The process is separated into the below sections:

- Sign up for MTD.

- Run a VAT reconciliation.

- Authorize Moneypenny

- Submit the VAT reconciliation to HMRC

Sign up for MTD

Before you can submit, you’ll need to make sure that your company is signed up for Making Tax Digital through this page.

Once you are registered, HMRC suggests that you wait up to 72 hours for your business record to be migrated to the MTD service (not instant). You will receive an email from HMRC confirming that you are now in MTD.

Run a VAT Reconciliation

Once signed up, you can now run your VAT reconciliation within mydaEs as usual by going to ‘Accts Payable > VAT Reconciliation’. Once reconciled, the authorize process will begin automatically.

Guidance on running the VAT reconciliation can be found here.

Authorize Moneypenny

Once you have reconciled, a new window will appear requesting that you authorize Moneypenny to interact with HMRC on your behalf.

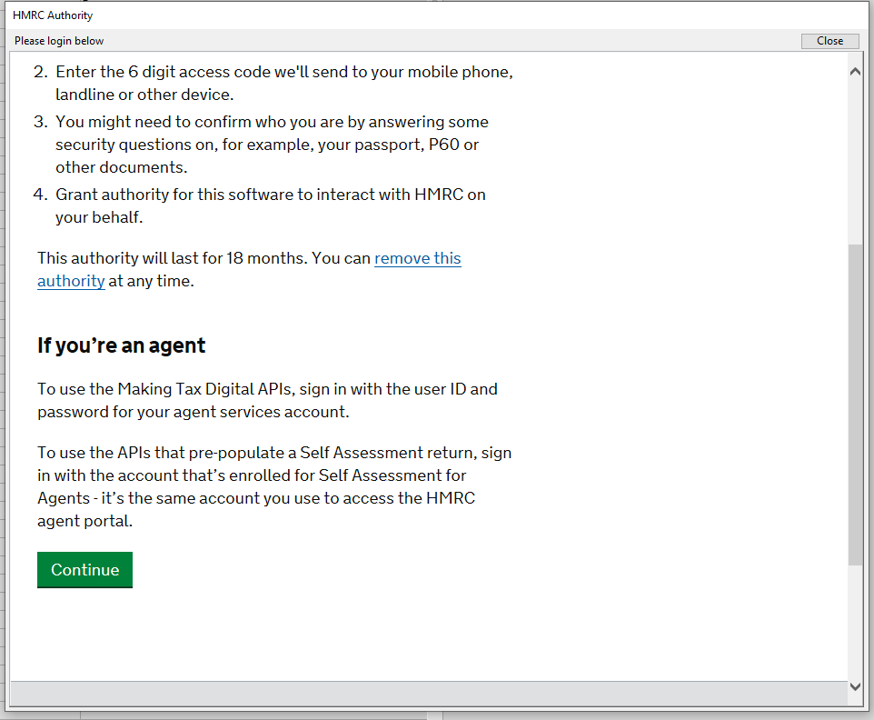

Scroll down on this page and hit the green ‘Continue’ button.

A page will appear asking you to login to your gateway account. Enter the credentials and hit ‘Sign in’

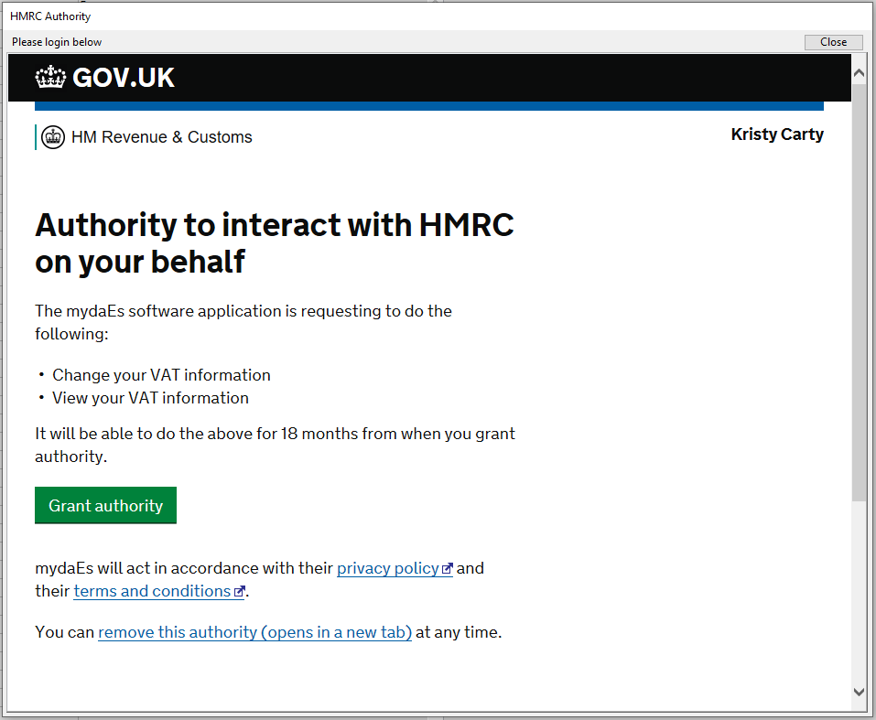

Once signed in, click the ‘Grant Authority’ button to give Moneypenny authority to make submissions.

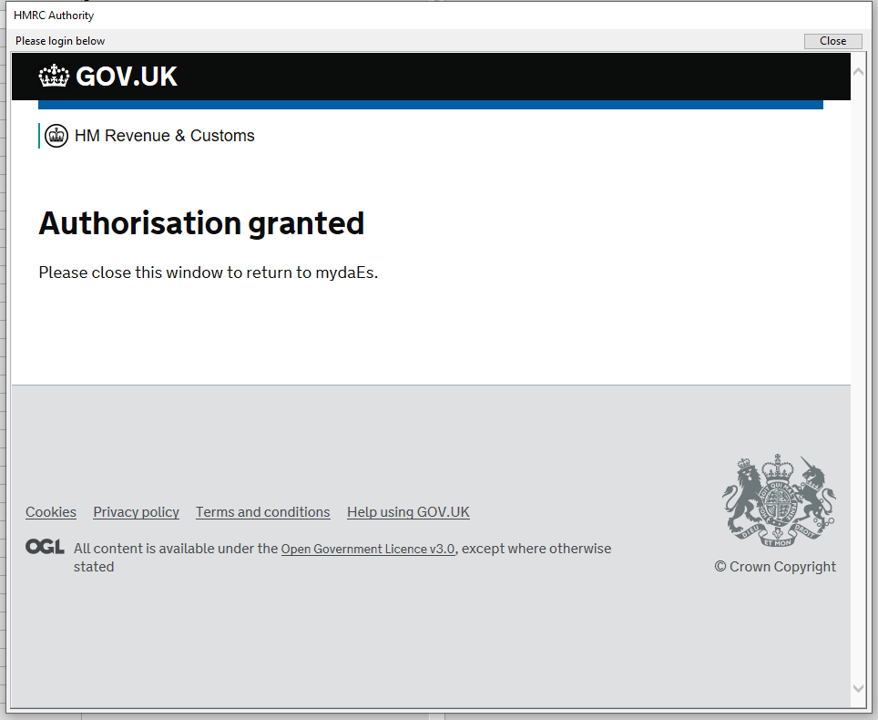

Done. You can now click ‘Close’ in the top right-hand corner to return to the Moneypenny screen.

Submit VAT to HMRC

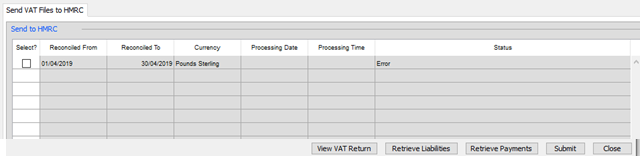

A box will appear displaying all VAT Reconciliations that the system has run with their current submission status. You can use the buttons in the bottom-right hand corner to query HMRC for information about your outstanding returns, liabilities or payments.

To make a submission, select the relevant VAT returns on the left-hand side, then click ‘Submit’.