Introduction

This procedure is intended to help users adjust the superannuation reported via STP for Cast under $450 per month & Extras over $450 per month.

- Check your Superannuation. Superannuation provision account on the balance sheet needs to be reconciled before you can start the EOFY adjustments.

- Super payments recorded to the provision account should match with the Superannuation payments out of the bank / via the clearing house.

- If there is an outstanding balance, the balance needs to be cleared with the June Super lodgements.

- Take a backup.

Procedure:

Overall, there are three general steps.

- Identify Cast under $450 per month & Extras over $450 per month.

- Adjust superannuation payments via payroll.

- Reconcile superannuation provision account on the balance sheet.

For any questions, please email Jenny Brooks jbrooks@moneypenny-group.com.

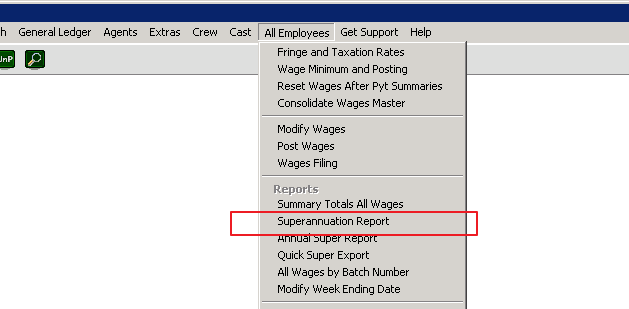

- Go to “All employees” Tab. Click “Superannuation Report”

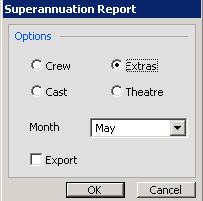

- Choose either cast or extras and the relevant months. You need to run the reports for both cast and extras for all the relevant months.

CAST UNDER $450 per month

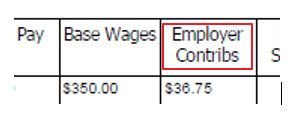

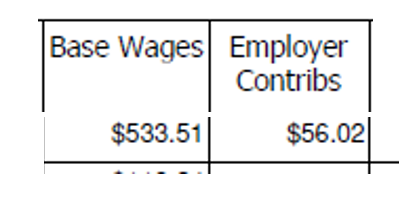

- Based on the cast Superannuation reports. Make a list of the people with “Base Wages” under $450. Their Employer contribution amounts needs to be adjusted in step 7.

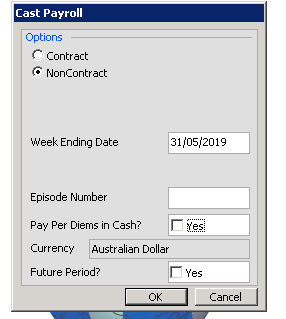

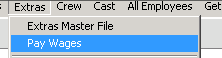

- Go to “Cast” tab; Then “Pay Wages”

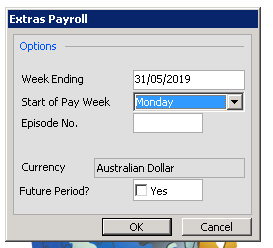

- Choose “NonContract” and have the week ending date the last day of the month

- Enter the Wages Code

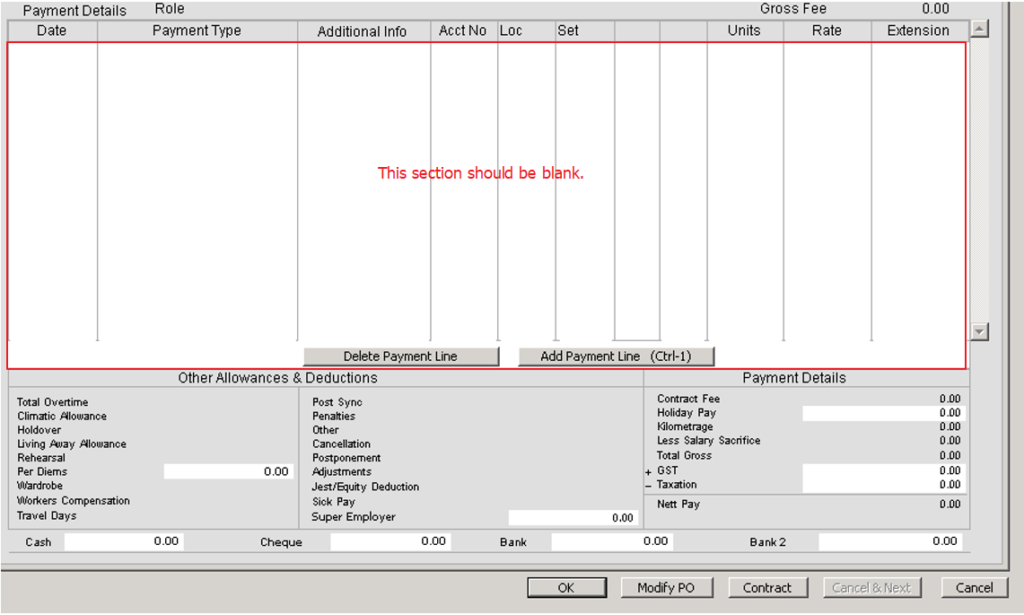

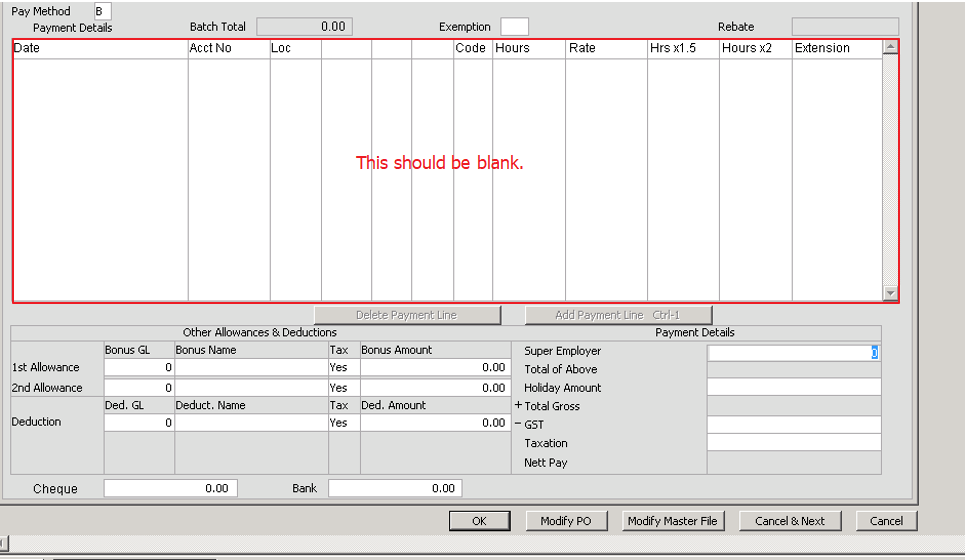

- Delete any default payment lines that shows up.

- It should look like this:

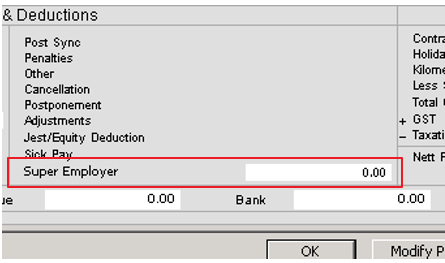

- Down the bottom you will see a new box called “Super Employer”. Contact Moneypenny support if you do not see this box.

- You will be entering in the “Total Contribs” amount into this box. Use the figures from Step 1 for each individual person.

Reminder that Cast under $450 adjustments will always be a negative amount in the cell.

- Click “OK” and move on to the next person.

- When finished, go back through Modify Wages and make sure that all amounts match to your super report.

- Once completed – post and print off the GL code to double check that all is correct.

EXTRAS OVER $450

- Make a list of the people with “Base Wages” over $450.

- Go to the Extras tab, then “pay wages”

- Have the week ending date the last day of the month

- Enter the Wages Code as normal

- Delete any default payment items that shows up.

- It should look like this:

Extras Over $450 will always be a positive amount in the cell.

- Down the bottom you will see a new box called “Super Employer”

- You will be entering in the “Total Contribs” amount into this box.

Extras Over $450 will always be a positive amount in the cell.

- Click “OK” and move on to the next person.

- When finished, go back through Modify Wages and make sure that all amounts match to your super report.

- Once completed – post and print off the GL code to double check that all is correct. +