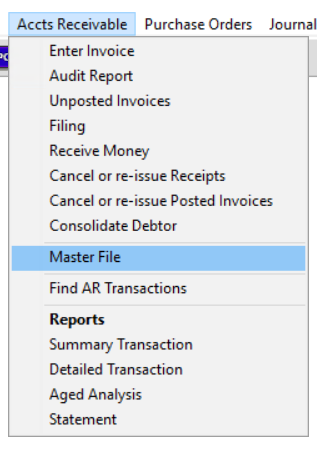

Go to Accts Receivable – Master File

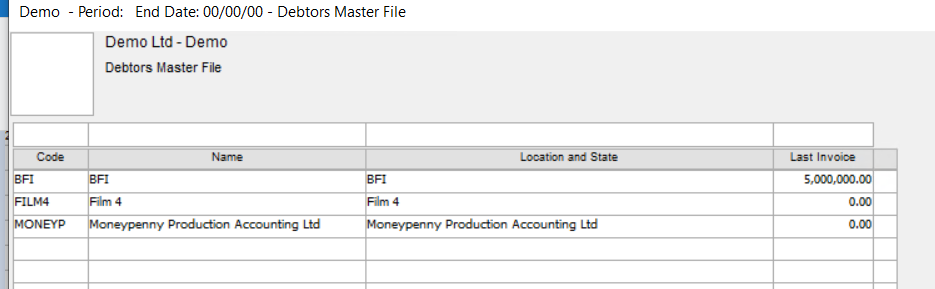

You will then see a list of any debtors. As usual, the column titles are buttons that can be used to sort those columns. We also have the white fields above each column where you can start typing in any text, and the entries below will reduce to display only those that matched what you typed.

On top of this, during data entry on invoices you will see a button at the bottom entitled CREDITOR. This will also take you straight to editing the master file record for this creditor/vendor.

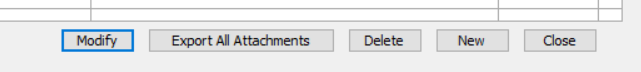

At the bottom of this screen you can choose to ‘Delete’ a particular creditor/vendor if they have not yet been used on a transaction, add a new creditor/vendor, ‘modify’ and existing creditor/vendor or choose to ‘Export all attachments’ that have been previously added to mydaEs for the creditor/vendor as a whole.

You can modify a creditor/vendor by either double clicking that row, or else selecting it and then pressing the ‘modify’ button.

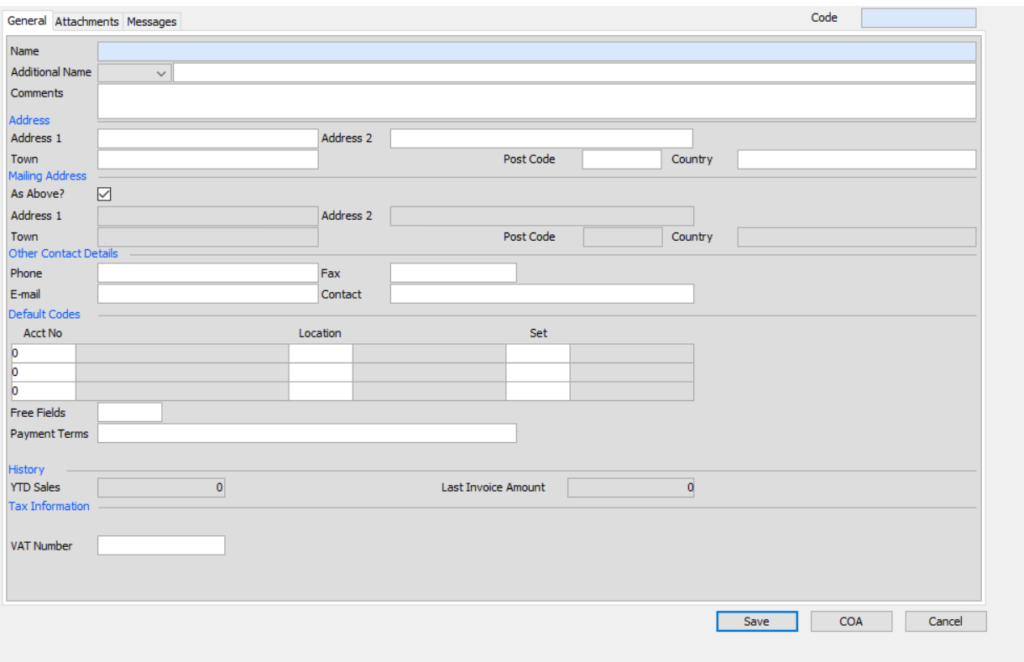

You will then see the following form. It is important to state here, that if you are using mydaEs from different countries this form will look slightly different depending on your countries requirements.

For United Kingdom it would look as follows.

At the top of this form, we can see some generic contact and address details, your wording may change of course if in your country you have no post codes, or you instead have provinces etc.

You can select up to 3 default account codes, which will automatically come up on new invoices to save a little data entry for you.

You can have different payment terms for different Debtors.

You can choose a default free field (if you are using free fields on this project) which will default this value in each time this creditor/vendor is used.

At the bottom of this screen you can choose to save your changes or look-up the COA. For more information on the COA lookup please click here.